In recent years, you've probably had the chance to see changes when dining out. The barcode displayed on your bill is the result of a sales recording module, commonly called SRM. It is through an SRM a restaurateur can collect data and save them in the context of his statements to Revenu Quebec. Mandatory since 1 November 2011, the SRM has caused some headaches with restaurant. Nevertheless, the data collected allows Revenu Québec to fight tax evasion.

Since 2010, when the finance minister at the time, Raymond Bachand, announced unprecedented measures to fight tax evasion. Among the measures announced, Revenu Quebec became, from April 1, 2011, an autonomous and accountable agency. The agency, earning power, could fight effectively against priority targets, such as the construction industry, contraband tobacco and restaurant.

François Meunier, vice president of public and government affairs for the Restaurant Association of Quebec, knowledge of the issue: "The government felt that there was an escape rate of about 14% in industry [restoration]. He felt that there was a loss of annual tax evasion of about 420 million per year. "

For 2007-2008, including the amounts received by the restaurant but not remitted to Revenu Quebec, we find $ 133 million in QST and $ 84 million in GST. Some companies were using ingenuity to pocket huge amounts by using zappers for example. However, the price is high for a such offense.

On March 11, 2008, an investigation by Revenu Quebec has led to eight search warrants in the Laval, Montreal, Mascouche and Châteauguay. The target company, Computer systems Logicaisse Ltd., has been accused of having designed and distributed zappers, also called zapper. The company was ordered to pay a total fine of $ 140,000. The story is far from over.

Computer systems Logicaisse Ltd. reoffended since, July 14, 2009, Revenu Quebec executed two search warrants at the headquarters of the company following an inspection that took place on January 30, 2009 April 22, 2014, at the end of a trial that lasted 16 days, the company was ordered to pay a fine of $ 350,000. Since August 9, 2014, Computer Systems Ltd. Logicaisse are no longer allowed to install SRM and provide computer support service because of broken trust with Revenu Québec. As we mentioned earlier, the price is high.

Another example of fraud concerns this time the company Resto Quebec inc. On October 13, 2011, a few weeks before the obligation of Quebec restaurateurs to comply with new control measures against tax evasion, Revenu Quebec executed three search warrants in Saguenay, Lévis and Quebec. The agency suspected the company of violating the Law on Sales Tax Quebec by failing to report the amounts of PST, for a total of $ 43,590 during the period 1 February 2006 to 31 January 2009 This omission could cost the company the amount evaded in addition to face prosecution and fines ranging from 125% to 200% of the amounts bypassed.

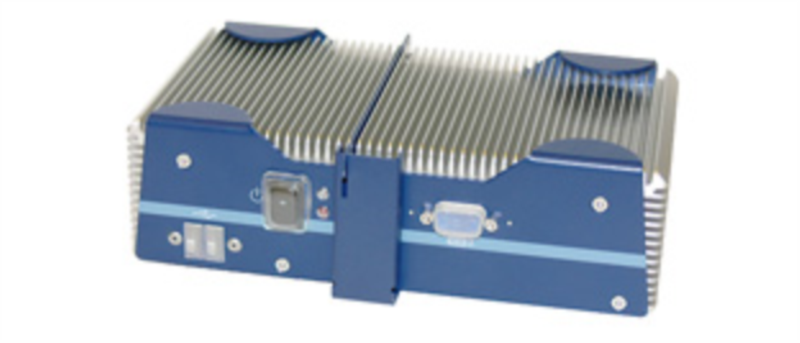

It is to avoid this type of fraud that in 2009, a pilot project using the MEV was created. This project, called mandatory Invoice in the restaurant industry, involved the participation of fifty restaurateurs and hoteliers volunteers. Five years later, what impact this project he had on the restaurant? It's what you know in the next article.

SRM Case 1/3 - The sales recording module, an ally against tax evasion

CHRISTINE HÉBERT / August 22, 2014

CHRISTINE HÉBERT / August 22, 2014

Recent / evaluations

Granby restaurant

Restaurant Maison Wong

I ordered takeout yesterday for my family. Everything was delicious. Thanks ??

Evaluation added on November 17, 2025 by Collette

Coteau-du-Lac restaurant

Brochetterie Naxos

Food was delicious with generous portions at a resonable price. It is one of favourtie brunch place!